Blog

Contents:

On the other hand CFD trading is far simpler, with a much smaller initial deposit required. There are many different brokers offering CFD trading, and the fees are also smaller. CFD trading of cocoa also allows the trader to set their leverage, which can make trading cocoa less of a risk. Data posted on this web page cover production and grindings of cocoa beans by the main producing/exporting and importing countries for the last three cocoa years. Although cocoa is one of the world’s smallest soft commodity markets, it has international implications on food and candy producers and the retail industry. Cocoa prices displayed in Trading Economics are based on over-the-counter and CFDs financial instruments.

Cocoa is the name given to the seeds of the cocoa tree and the powder produced from these. The cocoa tree is an evergreen tree with the biological name “Theobroma cacao” , which is resident in the tropical rain forest and can reach a height of 15 metres. Cocoa powder is needed to produce chocolate and is one of the most important export commodities from the developing countries. It only grows on nutrient-rich soil at temperatures in excess of 16 degrees. This makes both cocoa and coffee hugely valuable commodities, so much so, that coffee is the second largest export in the world, second only to oil. There are more than fifty coffee-producing countries where earnings from coffee as a commodity play a vital role within those country’s economies.

In Africa’s fields, a plan to pay fair wages for chocolate withers – Reuters

In Africa’s fields, a plan to pay fair wages for chocolate withers.

Posted: Tue, 04 Apr 2023 07:00:00 GMT [source]

Plantains are often intercropped with cocoa to provide shade to young seedlings and improve drought resilience of the soil. If the soil lacks essential nutrients, compost or animal manure can improve soil fertility and help with water retention. The relative poverty of many cocoa farmers means that environmental consequences such as deforestation are given little significance.

Cocoa is priced in either GBP or USD, so any swings in the value of these currencies can impact the value of the cocoa bean. Coenraad Van Houten develops chocolate powder in 1828 by designing the cocoa press, which creates butter from squeezing roasted beans. The 1600s sees cocoa powder trading increase across Europe as more drinking products are produced. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only.

What is the current price of cocoa and cocoa futures?

Moreover, they set and enforce rules to ensure that trading takes place in an open and competitive environment. For this reason, all bids and offers must be made through the Exchange’s “Clearing House”, via the exchange’s electronic order-entry trading system. As a result, the Exchange’s Clearing House acts as the buyer to all sellers and the seller to all buyers. Nibs are generally powdered and melted into chocolate liquor, but also inserted into chocolate bars to give additional “crunch”. For more info on how we might use your data, see our privacy notice and access policy and privacy webpage.

There are ways in which you can minimise your risk, which includes attaching stops to your positions. Stops will close your trade at a certain point if the market moves against you, to prevent you losing more than you’re prepared to. Cocoa trading strategies depend on the trader’s knowledge of technical indicators, and their personal preference.

Country with the highest cocoa consumption globally is the Netherlands handling 13% of global grindings. Europe as a whole consumes 40% of the markets with a remaining 60% that is equally divided between Asia, the Americas and Africa. Prior to March 2015, cocoa futures contracts were quoted only in British pounds sterling and in U.S. dollars. Cocoa futures contacts are now available in the three currencies.

Cocoa trading basics

Pricing analysis is covered in this report according to each type, manufacturer, regional analysis, price. Concern about the quality of some West African cocoa crops has limited any declines in cocoa prices. Cocoa farmers continue to struggle with the lack of fertilizer and pesticides as the war in Ukraine has limited Russian exports of potash and other fertilizers worldwide. The Statistics Section revises on a quarterly basis the cocoa beans production and grindings data. The posted table is updated in March, June, September and December.

One https://1investing.in/ futures contract is equivalent to 10 metric tons of cocoa, and the tick size is $10. Cocoa futures market trade on New York Mercantile Exchange and also the Intercontinental Exchange in London. And are the perfect choice for traders and hedgers who wish to get easy and cheap exposure to the cocoa market. Cocoa futures have a tick size of $10, and expire in the months of March, May, July, September, and December. The size of each cocoa contract on the NYMEX is 10 metric tons. The Mayas and the Aztecs worshiped the cocoa tree and used a drink made from its fruits in religious rituals.

Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. Both the CME and ICE offer an options contract on cocoa futures. The CME contracts are options on the physically delivered cocoa futures contract that trades on the CME Europe exchange.

When Are Cocoa Beans Harvested?

Report on the annual ICCO survey of cocoa bean stocks, aims to determine stocks of cocoa beans in European warehouses as at the end of each cocoa year. Most coffee production is in developing countries, while most consumption is in industrialised economies. The top coffee importer is the EU followed by the USA, Japan, the Russian Federation and Switzerland. Green coffee are shipped in bulk in lined containers or in either jute or sisal bags loaded in shipping containers. Exporters buy the coffee from farmers, co-operatives or auctions, and then sell on to dealers. It is typically sold to coffee roasters around the world in order to turn the beans into the products sold by retailers.

Cocoa- A New Multi-Year High in the Soft Commodity – Barchart

Cocoa- A New Multi-Year High in the Soft Commodity.

Posted: Thu, 27 Apr 2023 15:12:00 GMT [source]

Discover how to increase your chances of trading success, with data gleaned from over 100,00 IG accounts. Growing at aCAGRof 3.4%, the value of the global market for cocoa is expected to hit over $14.5 billion in the next five years. Cocoa plantations are predominately based in African countries such as Nigeria and Uganda, as well as some located in Asia. ● Economic impact on the Cocoa Beans industry and development trend of the Cocoa Beans industry.

The price of cocoa can be affected by factors such as changing weather conditions, distribution costs, geopolitics, global health issues and the strength of the US dollar. Also, the price of cocoa is moved by factors that relate to supply and demand. Once cocoa beans reach the port of export, they are stocked in warehouses, while being graded and subsequently loaded onto cargo vessels. Warehouses should have cement and non-flammable floors without cracks and crevices where insects can hide. Ideally, the floor level of the warehouse should be higher than the surrounding land to prevent flooding and to allow water to flow away.

CFD accounts provided by IG Markets Ltd, spread betting provided by IG Index Ltd and share dealing and stocks and shares ISA accounts provided by IG Trading and Investments Ltd. IG is a trading name of IG Markets Ltd , IG Index Ltd and IG Trading and Investments Ltd . Registered address at Cannon Bridge House, 25 Dowgate Hill, London EC4R 2YA. IG Markets Ltd , IG Index Ltd and IG Trading and Investments Ltd are authorised and regulated by the Financial Conduct Authority. The value of shares, ETFs and ETCs bought through a share dealing account, a stocks and shares ISA or a SIPP can fall as well as rise, which could mean getting back less than you originally put in. Explore the range of markets you can trade – and learn how they work – with IG Academy’s free ’introducing the financial markets’ course. Here is our archivewith articles about other tradeable futures markets.

Immature what is the difference between an erp and a crm pods have a variety of colours, but most often are green, red, or purple, and as they mature, their colour tends towards yellow or orange, particularly in the creases. Unlike most fruiting trees, the cacao pod grows directly from the trunk or large branch of a tree rather than from the end of a branch, similar to jackfruit. This makes harvesting by hand easier as most of the pods will not be up in the higher branches.

The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. 75% of retail client accounts lose money when trading CFDs, with this investment provider. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Cocoa production is likely to be affected in various ways by the expected effects of global warming. Specific concerns have been raised concerning its future as a cash crop in West Africa, the current centre of global cocoa production. If temperatures continue to rise, West Africa could simply become unfit to grow the beans.

What is the tick size of cocoa futures?

Since cocoa is a soft commodity and a crop, this is particularly important. Cocoa trading prices can be heavily influenced by external factors, so being wise to news stories that could impact the supply of the bean to the global market is advised. Some examples include African droughts or even the Evergreen cargo ship blocking the Suez Canal. External Factor Influence – Cocoa commodity trading can be heavily influenced by external factors on crop supply, such as the weather and political unrest.

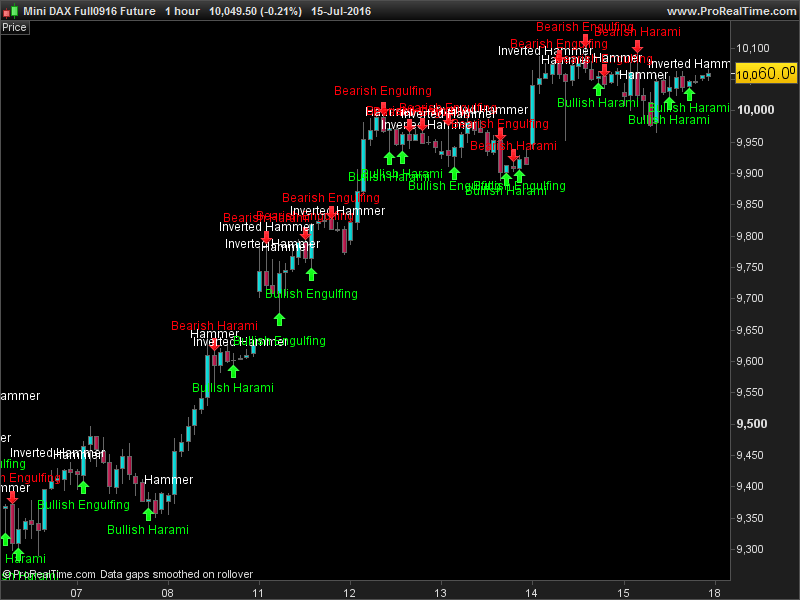

- Cocoa trading strategies depend on the trader’s knowledge of technical indicators, and their personal preference.

- Cocoa farmers continue to struggle with the lack of fertilizer and pesticides as the war in Ukraine has limited Russian exports of potash and other fertilizers worldwide.

- There is an ETF that offers pure-play exposure to cocoa prices.

- The CME contract trades globally on the CME Globex electronic trading platform and has expiration months of March, May, July, September and December.

- Futures are the most popular way of trading cocoa, offering high liquidity and volatility.

Chapter 2 provides a qualitative analysis of the current status and future trends of the market. Industry Entry Barriers, market drivers, market challenges, emerging markets, consumer preference analysis, together with the impact of the COVID-19 outbreak will all be thoroughly explained. Last Wednesday, Gepex, a cocoa exporter group that includes six of the world’s biggest cocoa grinders, reported that its Q1 cocoa processing jumped +22% y/y to 189,405 MT. A negative factor for cocoa is an increase in current inventories after ICE-monitored cocoa inventories held in U.S. port warehouses rose to a 3-1/4 month high of 5,430,809 bags on Wednesday.

Other media followed by reporting widespread child slavery and child trafficking in the production of cocoa. The wet beans are then transported to a facility so they can be fermented and dried. The farmer removes the beans from the pods, packs them into boxes or heaps them into piles, then covers them with mats or banana leaves for three to seven days. Drying in the sun is preferable to drying by artificial means, as no extraneous flavors such as smoke or oil are introduced which might otherwise taint the flavor. Once you’ve familiarised yourself with the different ways to trade cocoa, you can choose which method best suits your trading strategy and risk appetite.

Unfortunately, most cocoa-producing companies are not listed on the stock exchange. Then you can consider buying shares that are involved in the production of chocolate. Cocoa is the most important ingredient for a tasty chocolate bar. For private investors, it’s possible to speculate on price increases and decreases in cocoa prices with CFD’s.

There are many types of cocoa assets to trade, the most common of which are futures contracts. Cocoa assets have a varying level of complexity, with purchasing shares of cocoa trading companies the most straightforward. Whether you want to own the underlying asset or not will also determine which instrument you choose. It is essential that traders fully understand the asset before they invest, especially if leverage is involved.

It is considered to be of much higher quality than Forastero, has higher yields, and is more resistant to disease than Criollo. With CFD trading and spread betting, you can deal on changing prices of cocoa futures and options, without buying or selling the contract. CFD trading and spread betting use leverage, which means you only have to put up a small margin to gain exposure to the full value of the trade.

The genetic purity of cocoas sold today as Criollo is disputed, as most populations have been exposed to the genetic influence of other varieties. In a range trading strategy, a trader will identify levels of support and resistance in an asset’s price movements and seek to buy at levels of support and sell at levels of resistance. Range strategies work best in markets with lots of price movements, where there is not any particular long-term trend.

- People around the world enjoy cocoa in many different forms, consuming more than 3 million tons of cocoa beans yearly.

- Traders can trade CFDs and get involved with spread betting, where gains can be made on the value of cocoa without owning the asset itself.

- If the soil lacks essential nutrients, compost or animal manure can improve soil fertility and help with water retention.

- Similarly to sugar and coffee, cocoa is also traded in futures contracts on many exchanges in order to manage price risk for consumers and for producers to secure selling or purchase prices.

The product which is left after the cocoa butter has been extracted. Historically, Cocoa reached an all time high of 5379 in July of 1977. Cocoa – data, forecasts, historical chart – was last updated on May of 2023. Past performance is not a reliable indicator of future results.

Farmers can grow a variety of fruit-bearing shade trees to supplement their income to help cope with the volatile cocoa prices. Although cocoa has been adapted to grow under a dense rainforest canopy, agroforestry does not significantly further enhance cocoa productivity. Agroforestry practices stabilize and improve soil quality, which can sustain cocoa production in the long term. The cocoa industry was accused of profiting from child slavery and trafficking.